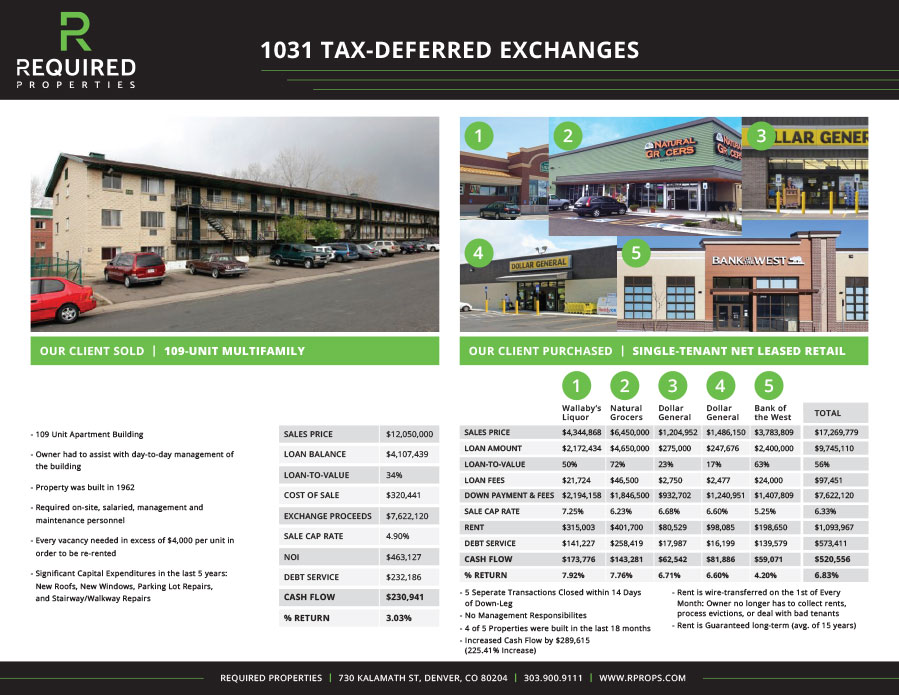

Tax-Deferred Real Estate Swaps

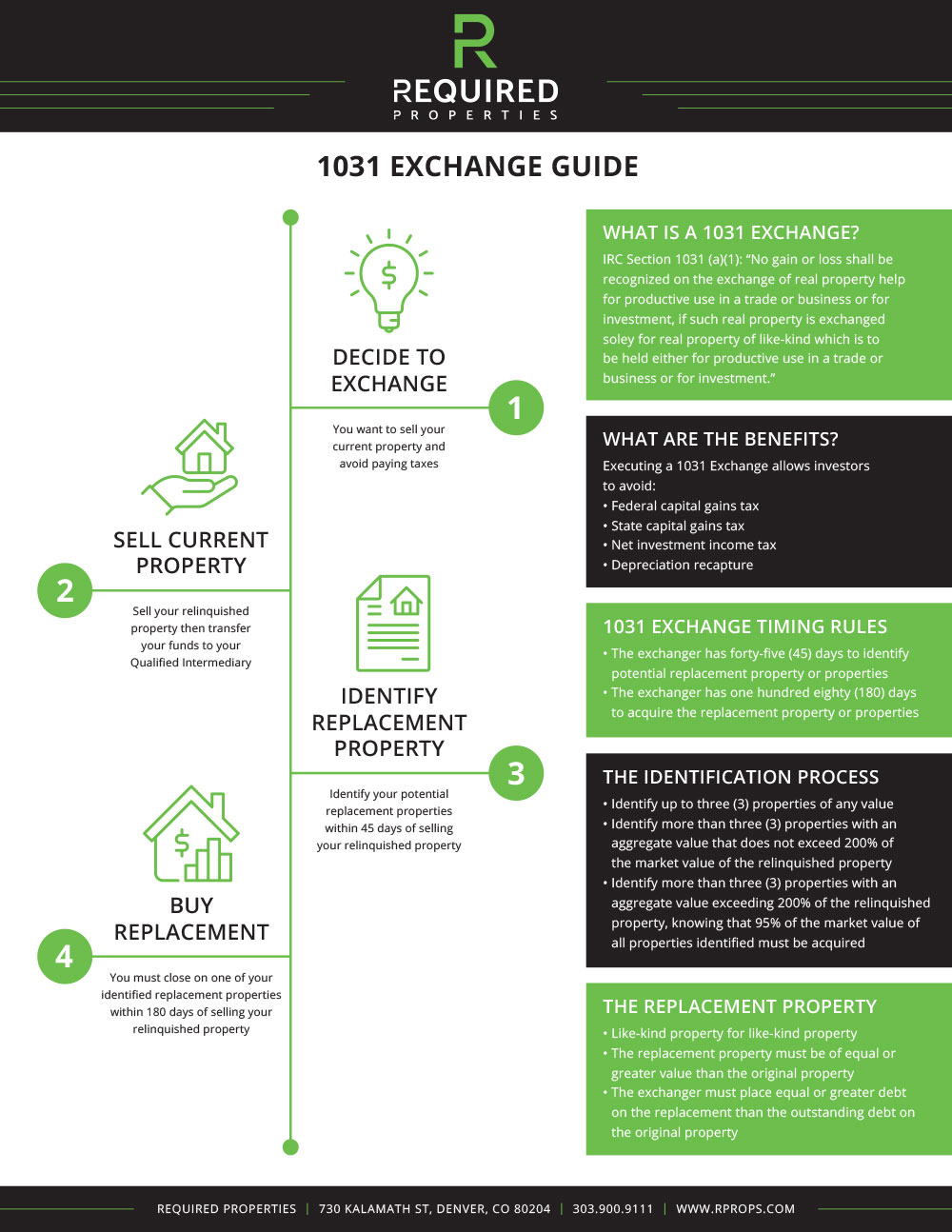

A properly executed 1031 Exchange allows investors to defer taxes on the profits from selling a US investment property when the proceeds are reinvested in a “like-kind” US investment property within set time limits. The tax deferral frees up additional capital for investment in the replacement property. Specifically, executing a 1031 Exchange allows deferral of:

- Federal capital gains tax

- State capital gains tax

- Net investment income tax

- Depreciation recapture

Internal Revenue Code (IRC) Section 1031 (a)(1)

“No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment, if such real property is exchanged solely for real property of like-kind which is to be held either for productive use in a trade or business or for investment.”

How It Works: Requirements & Timing

Successful 1031 Exchanges require thoughtful, strategic, timely execution that reduces risk while opening the door to greater earning potential. Let Required Properties guide you through every step of the process.